My Forex 2021 |

|

Forex Online

Forex Basics Basic Charts Forex Terms Forex Hours Trading Examples Overnight tax World's Currencies Forex Platforms News & analysis Free Forex Software History of money Opportunity Forex experiences - Emotions Pandemic Speculations Links |

Another year is behind us. Some see it positively, others negatively. The process is natural and there is no point in defining it. Sorry, but sometimes I get

a philosophical streak, so I have to say something. That year before brought us great news; the covid pandemic. In 2021 this contagion has definitively spread,

everywhere. Things were really bad at first, but we didn't have to wait long for mass vaccinations. This seemed to bring a positive result with the decline in

the contagion curve, but then summer came and the curve started to rise again. At the end of the year, a new variant emerged that is spreading very quickly and

all countries have far exceeded their previous records. Many people have begun to doubt the effectiveness of vaccination and in a certain sense a rift has been

created in society, from England, through Germany, to the United States.

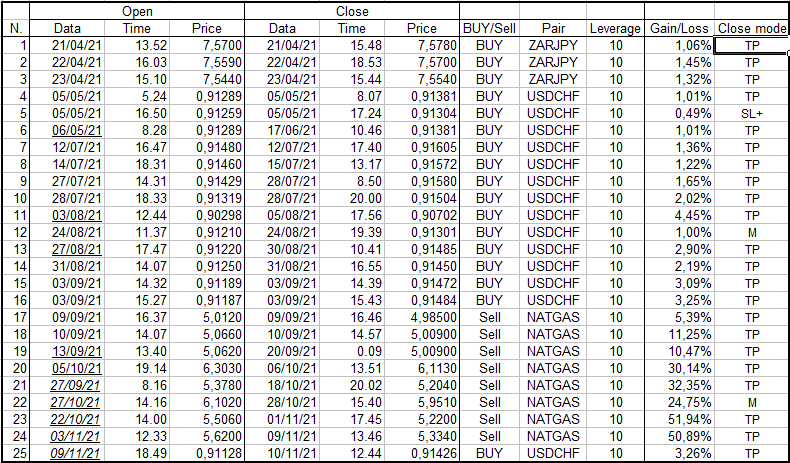

Sometime before the summer, when the situation looked pretty good and improving, the world financial markets were euphoric: an economic recovery was expected and everyone was rushing to invest in this new positive wave. Then problems began to appear and things began to change in part, but the positive trend was still dominant. At the beginning of the year, for the first 3 and a half months, I stopped trading currencies due to health problems, unrelated to the covid; due to my age. The previous Forex period was not good for me because I made a lot of mistakes, I misjudged some situations and I suffered from a lack of patience. I wrote all this on a piece of paper and taped it under the computer screen to remind me before making important decisions. I have to say it worked well. This is my best year since I started trading Forex. Below is a table showing all my Forex trades during the year. I opened 25 positions and closed the same number. The best thing is that in the end they were all positive: in no case I lose my money, always only gain. If you allow me a little pride, I was great! I opened about 3 positions a month: the first 3 and a half months and the last two I was practically inactive. The latter two for the reason that I did not see favorable opportunities and also did not want to ruin the annual statistics. This shows that I was patient, that I didn't force things when I didn't have a positive feeling and that makes me very happy. In the table, underlined opening dates indicate that the position was not closed on the same day. Here is a short legend that explains closing mode.

I started towards the end of April with buying of the South African rand (ZAR) against the Japanese yen (JPY). Three operations in three days, all positive, just to warm me up a bit. Profits ranged from 1 to 1.5 percent; little but certain. This was followed by a period of several months in which I was buying the US dollar (USD) against the Swiss franc (CHF). This currency pair has regular swing, as the jargon goes, that is, it swung up and down around a relatively stable value. The profit was variable, ranging from 0.5 to 4.5 percent. Then came September. After the summer, many of us have the feeling of starting from scratch, with new strength because during the holidays we have recharged the batteries with new energy. This is how I felt when I saw something strange happen with natural gas. It is not my habit to trade commodities, but when an opportunity arises it must be grasped. I grabbed it and did it very well. Virtually 95% of the gains I made during the year were due to the 8 positions I opened and closed during September and October, selling natural gas. Earnings were excellent, between 5 and 52 percent. Objectively, investing with leverage 10, as you can see in the table, in such a dynamic period of a financial instrument is not very advisable; the price of natural gas has practically doubled in just two months. My instincts told me I couldn't go wrong. I rarely feel instinctively what I have to do, but when it happens, I'm never wrong. It prompted me to accept the increased risk the fact that I had substantial liquidity in my account. This allowed me to defend my positions and therefore to reduce the level of risk to a minimum. I was also very happy with my psychological hold during times when the price was rising so much; I was selling, so I needed a price drop. I was not upset and I had serenely waited a few days for the trend to change: it has always happened. The price simply couldn't go up indefinitely. In all of this, it was also good that the sale of natural gas brought with it a positive overnight rate, so the expectation alone brought in a few more dollars. Better than that... I hope my Forex trading continues just as well next year. |