Natural gas |

|

Forex Online

Forex Basics Basic Charts Forex Terms Forex Hours Trading Examples Overnight tax World's Currencies Forex Platforms News & analysis Free Forex Software History of money Opportunity Forex experiences Pandemic Speculations Links |

November, 2021

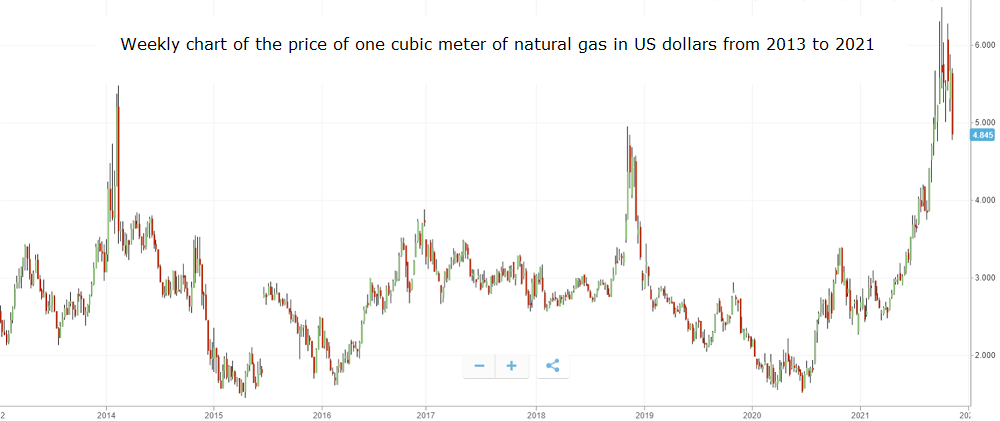

Times change and today all Forex service providers, in addition to currency trading that is their basic product, offer customers a number of other products that they can trade with. Probably the most widespread product, after currencies, are the shares of various companies, the indices of the stock exchanges, cryptocurrencies and what interests us here, commodities; oil, gold, copper and so on. The topic of this article is natural gas, which in recent months has given many traders the opportunity to make excellent profits. Unfortunately, as always, the majority of traders have also lost significant amounts due to a wrong trend assessment, or a wrong approach in trading. Natural gas, abbreviated NATGAS, is one of the basic fossil fuels that has wide application in both industry and homes. I believe most of us have a gas stove and/or water heater in our home, and many even use it for heating as well. The price of gas can be expressed in various ways, for example per kW of energy given by a certain amount of gas. Here is the price used in the Forex market, the natural one that does not require any conversion: the price we will talk about is US dollars per cubic meter of gas. Let's take a look at the graph below. It shows the trend in the price of gas, on a weekly basis, from 2013 to today, ie mid-November 2021. The average price in this period was approximately about 3.00 USD per cubic meter. A sharp rise in the price can be seen in early 2014 and another one in late 2018. In this period, precisely on 6 October 2021, the highest price ever, of almost 6.50 USD, was reached. The previous highest price was 5.48 USD in early 2014. This means that the new peak reached is approximately 20% higher than the previous one. The previous two peaks occurred in the winter months and are not difficult to explain them with an increase in demand due to the energy needed for heating. This recent peak happened in early October when the weather was hot. Why did this exception happen?

Why has the price of natural gas increased?I returned from vacation towards the end of August. In mid-September, looking for opportunities for some good investments, I noticed a growing trend in natural gas. First, I searched online for the reason for that growth; it is always good to inquire before investing money in a financial product. The explanation was the end of the pandemic and the growth of the world economy that followed. That explanation didn't convince me too much. The growth of the economy is an objective thing, but in the end the economy did not overcome the pre-pandemic one. The price back then was around 3 USD and has now doubled. I do not believe that the resumption of gas extraction, which may have been blocked in some fields, will increase the cost of production that much. I kept looking. I found a lot of explanations of all kinds. The most amusement was the claim that the wind in Europe was very weak and that wind power generation was significantly reduced, causing increased demand for gas.

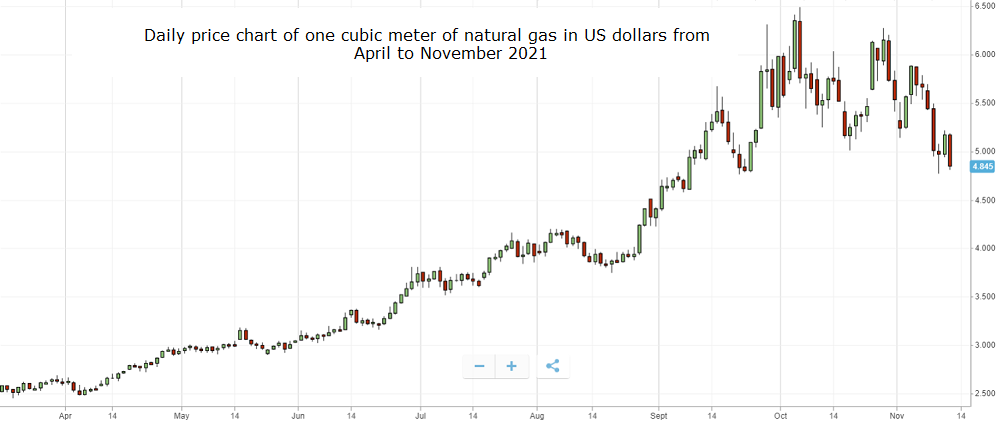

At the end of my research I came to the Russian question. A new Nord Stream 2 pipeline was to be opened this year, which would bring gas from Russia to Germany along the bottom of the Baltic Sea. The United States opposed the project from the start because it went against their economic interests: they want to export liquefied gas to Europe by ship. They constantly pressured Germany to give up the contract and at one point the completion of the pipeline was questioned. Putin, the Russian president, has decided to play the stronger card he had. Gas supplies to Europe have been reduced. The tanks in which the gas is stored during the year to be available in sufficient quantities when consumption is maximum and the pipeline cannot meet this demand, were at one point half empty. Panic ensued, not about what was happening, but about what might have happened with the arrival of winter. The price started to skyrocket and leading Russian producer Gazprom was very happy. Europeans got scared and stopped putting up obstacles that slowed down the pipeline's construction. In one move, Putin has achieved two goals: he will have his pipeline and Russia will have huge profits due to the price increase. How to make money on Forex?This event, the rise in the price of natural gas, was a great opportunity for Forex traders to replenish their portfolios. The tactic of those who made good money was to sell the gas and secure a high Stop Loss limit in case the price continues to rise. It was not possible to know what level the price could reach, but what is certain is that it could not go to infinity. It was enough to have enough money available to avoid the risk of automatic negative closing of the position. The other important requirement was patience to wait for the price to drop and take a big profit. Most of them also took a rather large risk, using 10x leverage; it took more money to provide high Stop Loss protection, but the profits went well over 100%. A 10% price drop, with a leverage of 10 is exactly 100% of the gains. The graph above shows that such a variation, and even greater, occurred even in a single day.However, most of those who decided to invest in gas have lost money. I don't know why and with what logic, but they mostly bought. I think they used the rule that the best Forex tactic is to follow the trend. The rule is correct, but there are exceptions and it must be interpreted. When the trend is so strongly expressed, it is also a possible sign that it will end soon. Many of them initially made good money and continued with the same tactic, buying, even though the price continued to rise inexorably and far exceeded the previous high. When it started to go down, the fall was so strong that many failed to defend the position, although the defense in this case would be meaningless as it is clear that the final price, in a couple of weeks or months, will go down, below 4 USD per cubic meter. |